For several weeks now there has been speculation of Virgin America looking to be taken over. Just about the entire US airline industry is profitable right now, so I guess Virgin America thinks they’re at the top of their game, since they weren’t doing very well financially prior to the pat couple of years.

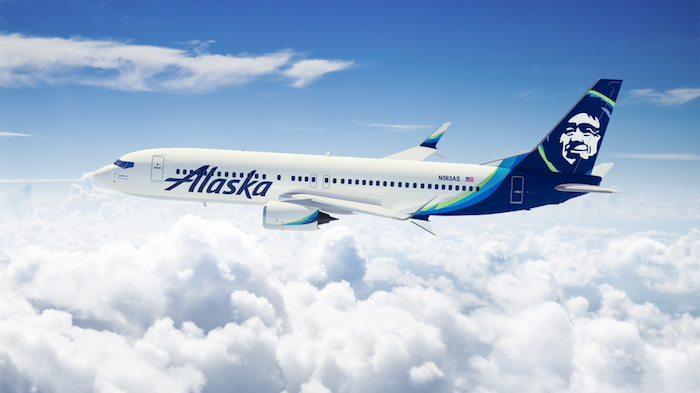

On Saturday it was reported that a merger between Alaska and Virgin America would be announced shortly, a deal which was expected to be worth $2 billion.

Well, that’s even closer to being confirmed at this point, though the price is even higher. It’s now being reported that Alaska will announce a $2.5 billion purchase of Virgin America tomorrow (Monday). That’s insane. Per The Wall Street Journal:

Alaska Air Group Inc. is expected to announce on Monday that it won the auction for Virgin America Inc., besting rival JetBlue Airways Corp. in a frenzied bidding process that culminated in a cash price of about $2.5 billion, according to people familiar with the matter.

Bidding between Alaska Airlines’ parent and JetBlue was feverish, this person said, with the price continuing to rise. Alaska prevailed in part because of its clean balance sheet, which will allow it to more easily borrow funds for the acquisition, the person said.

A person familiar with the jousting said it was “a fierce back and forth between the two sides, with multiple bids for a number of days.” But ultimately, JetBlue “put the pencil down” because the price had gotten too high.

It’s interesting to see that there has been a very active bidding war. JetBlue and Virgin America would have been a good fit, though JetBlue had the common sense not to overpay for Virgin America. Alaska, on the other hand, really wanted to buy Virgin America, because they’re paying more than a billion dollars over the airline’s market cap last Friday.

I’m guessing Alaska’s purchase of Virgin America is more reactive than anything. Alaska’s fear was presumably that JetBlue would purchase Virgin America, and therefore they’d be encroaching on Alaska’s turf. JetBlue has traditionally been strong on the east coast, and with this merger they could have expanded nicely on the west coast. So I get that logic, in theory.

But still, way overpaying for an airline which in and of itself doesn’t bring that much to the table is perplexing. It’s not like we’re talking about a powerhouse like Delta knocking our a competitor for giggles. Instead we’re talking about a much smaller airline like Alaska, which has been successful because of what a lean and conservative operation they’ve run. So I stand by my earlier thoughts about why I think Alaska and Virgin America aren’t a good fit.

I’ll be curious to see how Alaska’s stock price responds in the morning. Wow…

Going back to Alaska ifor a wedding. I will be stuffed in an AKAir seat. Sardines have more room in the darned can than in AKAir seats. Circumstances did not allow me to research other modes of travel. There must be a way to travel by air and, if not comfortable, at least make it bearable. Some airline that doesn't for some poor 6 foot guy behind me to sit with his knees in my...

Going back to Alaska ifor a wedding. I will be stuffed in an AKAir seat. Sardines have more room in the darned can than in AKAir seats. Circumstances did not allow me to research other modes of travel. There must be a way to travel by air and, if not comfortable, at least make it bearable. Some airline that doesn't for some poor 6 foot guy behind me to sit with his knees in my kidneys.

There is no excuse for commercial airlines to reduce passengers to cargo status. Next time - I'll drive. The AlCan is gorgeous,

and my Subaru is comfy

and I can take my dog without subjecting him to sub-cargo status

and I can stop and eat where I want

and I don't have to eat plastic food

and I don't have to deal with crabby flight attendants.

I'll bet the CEO doesn't travel like that. Let's take some of his money and give everyone at least 6 more inches knee room (3 inches?). Alaska's outlay on Virgin Air was inappropriate given that Alaska won't even do the right thing for the planes (and customers) it already has.

Oh, and now the mileage required has gone up? Unimpressed, Marthalynne Webb, former frequent flyer of many airlines since 1960.

I'm curious that Alaska isn't concerned about SFO tanking Alaska Airline's on-time performance.

Not a fortune, just a car's worth. Only risk what you can lose. As of this morning, got 7X or better initial investment.

Yes wish had more, but that's when it goes south.

@JF "including debt it’s 4 billion…" That's not how it works. Price + acquired debt does not equal total cost. Virgin also as nearly 500 million in Cash. Also they have something called "Assets" which is those planes they fly around (even leased planes have value in fact. With today's Captial leases (which I don't know if virgin uses) the leased planes go on the book aa assets. The payments on these leased are classified as long term debt.

It does not take a financial analyst to look up Market Cap and understand its meaning. The fact is Alaska Airlines is paying a huge premium above the Market Cap for this stock...way more than is customary. Based off the pre-market this morning those May options M Simons purchased are going to be worth a fortune.

@Dom I am not complaining at all bought some Virgin America stock this past week. And now pre market this morning it is already 54 a share. It doesn't take an investment banker to understand that Alaska way overpaid for this stock and I am making about a 70-80 percent return in one week. @Keith it's called market cap. That's the number of the shares outstanding times the stock price. Yes it is speculative but...

@Dom I am not complaining at all bought some Virgin America stock this past week. And now pre market this morning it is already 54 a share. It doesn't take an investment banker to understand that Alaska way overpaid for this stock and I am making about a 70-80 percent return in one week. @Keith it's called market cap. That's the number of the shares outstanding times the stock price. Yes it is speculative but to go almost twice the market cap is crazy. But here is the bottom line with that. After the buzz of the merger Virgin America already saw an increase in stock price to get the market cap close to 1.5 billion that means all of the shares total 1.5 billion in value. Alaskan over paid 1 billion on this deal. That's how he is coming up with these numbers. @ Samuel yours has already been addressed as this deal is not 5.5 times earnings but closer to 15-20. Plus think about how to cost of fuel has benefited the airlines...you can't just look at the last year or 1/4 and make valuations off that. @M Simons if you played those options right forget a car you could get a house or retire. I am kind of mad I bought the stock rather than the options but I never thought Alaska would pay that much for the Virgin America.

including debt it's 4 billion...

So Ben is now an investment banker? That just gave me the giggles.

Announced in press release at 3am PT today. Deal is done. $2.6b in cash, closing Jan 2017.

It's *extremely* difficult to determine the value of a company, as many people disagree on the proper way to do so. With that said - Ben, how do you figure that this is "way overpaying" ? What do you value Virgin at, and how did you come up with that number?

What Corp valuation technique did you use to determine it's overpriced?

@Samuel How are you getting 5.5x earnings? Wasn't VX's operating income in 2015 around $200M (with record low oil prices) and less than $100M in 2014? So assuming a median of $150M, that's something like 17x earnings.

Sounds like Alaska is convinced that the small players are going to be left behind.

@beachfan - interesting comment. It does seem that both Alaska and JetBlue wanted scale to compete with the big guys. Combined all 3 would still be half the size of United which was #4 in 2015.

Just curious as to what credentials makes you an airline financial expert?

The angle many are not bringing up is perhaps it is a shield to a hostile take over bid? Not sure but there seems to be so many reasons that we may not have visibility into.

AA and UAL are valued at roughly 3-4 times earnings, Delta is valued at 8 times earnings... This deal is valued at 5.5 times earnings, Ben (or anyone) can you support your statement on that AS is overpaying?

At that price, it is bad news, I now agree!

Only way it makes sense if it's on it's way to a trifecta merger with Jet Blue.

So now Ben is also a stock analyst and an investment banker, all without a lick of financial training or experience. What's next? Self-taught astronaut?

@M Simons:

Jealous! I wish I could trade options (it's prohibited - I work in the industry...)

Enjoy your new car!

Appreciate the pretty early comment on this, took some May options on VA last week. Will at least pay for next vacation I trust, maybe along with a new car.

Delta paying $360 million for 49% of Virgin Atlantic seems like a bargain in comparison. Virgin America made $177 million last year probably due to low oil prices. If oil goes back to more normal prices the premium Alaska paid to buy them is mind boggling.