A couple of days ago Ben wrote about why you should want to have as many no annual fee American Express credit cards as possible. That’s because each card gets its own set of Amex Offers, which are really cool and often lucrative cashback savings opportunities. And the more cards you have, the more offers you can get since they tend to vary a bit between cards.

Like Ben, I haven’t always taken advantage of Amex Offers though. I once thought they were too complicated or would only be for things we wouldn’t normally buy. But it turns out, this old dog can learn new tricks — I’ve since discovered that they are really easy to load to your account, and they are sometimes for things we actually need. In short, they are surprisingly easy to use and the credits post automatically as well.

Anyway, once you’ve taken Ben’s advice and acquired several no-fee Amex cards, you might be ready for the next level of optimization. And that involves adding some authorized users to your accounts.

Why add additional cardholders?

Generally speaking, each authorized user on an Amex account gets their own unique credit card number. This is in contrast to Chase, where, in my experience, everyone on your account shares the same number.

Since the Amex authorized user gets their own card number, they are also eligible for Amex Offers. In fact, your authorized user will likely have the same set of offers you have. So if you get an offer that you like, not only can you load it on your card, but you can also load it on their card as well.

Is adding authorized users a hassle?

I’ve known about Amex Offers for a long time. And I’ve known that Amex authorized users are eligible for their own Amex Offers. And I’ve known that many cards let you add authorized users for free.

Yet I still hadn’t added any authorized users to some of our accounts. Why? Because I assumed it would be a bit of a pain, and would almost certainly require a phone call. Which I detest.

But it turns out that it’s really easy, and, at least for my accounts, could be done completely online in just a few minutes.

How to add authorized users to American Express cards

I have two business cards, the Marriott Bonvoy Business® American Express® Card and The Business Platinum Card® from American Express. I had never added my wife to these cards, so I figured I should finally do that.

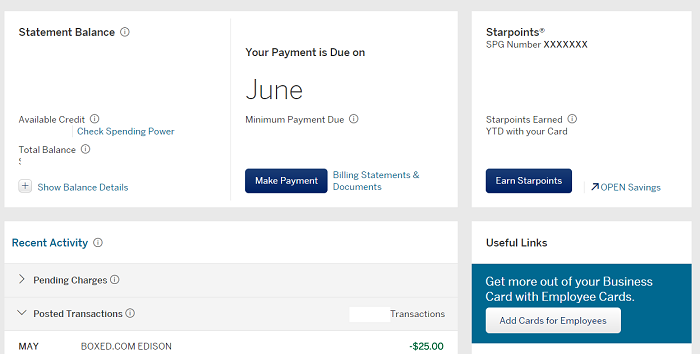

First I logged into my account and selected my Starwood Business Card. Then on the right panel, there was a link to add employee cards.

Perhaps fittingly, my most recent transaction is credit from from Boxed.com, courtesy of Amex offers

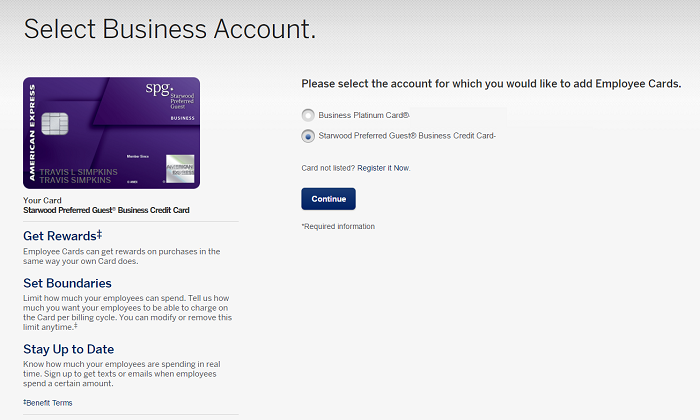

Then I selected my Starwood Business card as the one I wanted to add an authorized user to. (I later repeated the process for my Business Platinum.)

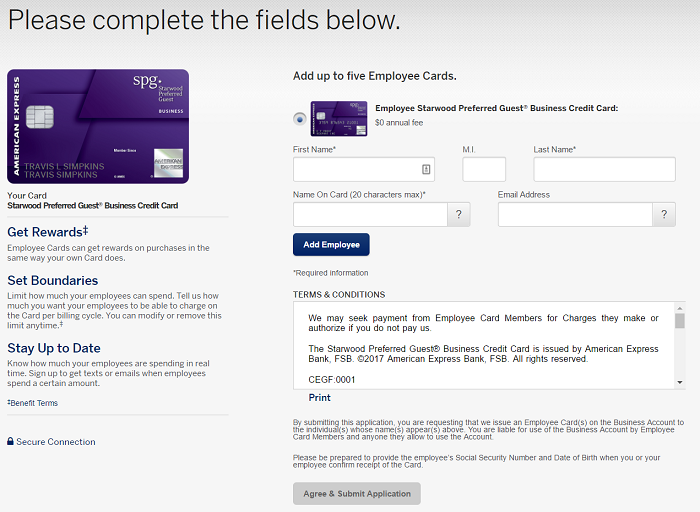

I filled out some basic information, mostly just name and email address — and submitted the application. (Note that I could have added up to five authorized users at once.)

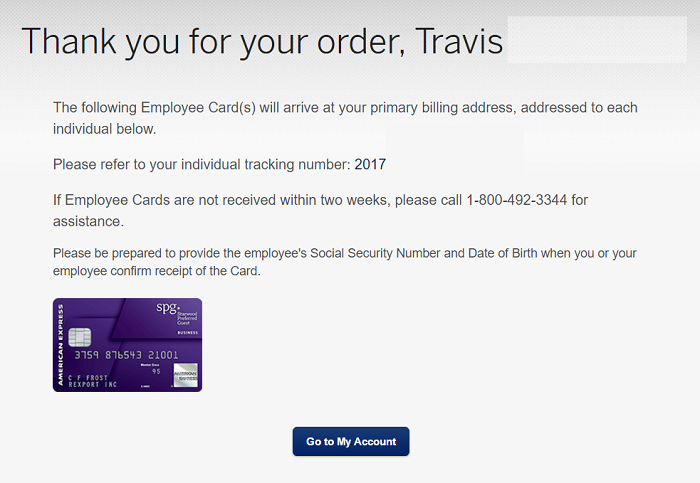

A few moments later my order was acknowledged. Apparently I will need to enter the social security number and birthday of the authorized user when the card arrives.

That was it. I was literally done in two minutes.

When I repeated the process for my Business Platinum Card, I made sure to get my wife the Green Card, which has no annual fee (Rates & Fees). There might be some reasons to get the Platinum or Gold version, but for now, I just wanted to have another card eligible for Amex Offers.

Bottom line

Amex Offers is a great way to save some money on things you were going to buy anyway. And the best way to maximize your use of Amex Offers is to add some authorized users to your accounts.

Of course you should only add people you trust since you’ll ultimately be responsible for their charges. But it’s definitely a good way to leverage your benefits and, in my case, justify paying the annual fee on some cards I might otherwise have canceled.

Are you using authorized user cards for Amex Offers?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Business Platinum® Card from American Express (Rates & Fees).

Who receives the AU’s card if the AU lives in a different state. Do I receive it or it gets shipped to them?

Who receives the AU’s card if the AU lives in a different state. Do I receive it or it gets shipped to them?

This is a business card, adding employees (that works for the business). Does it work the the same way for a personal card ?

I am an AU for both a BofA Alaska and a Barclays JetBlue card and both show up on my credit report.

Some of the personal AUs get reported to Credit Bureaus and will count against your 5/24 count.

@DanInMCI Citi AU's also get reported to credit bureaus. I am an AU on my wife's Citi Costco card and it shows up on my credit report.

Careful. Amex has shut down a number of accounts for abuse of this. As long as you are just adding an AU for your wife or spouse you should be okay, but don't abuse the system.

Does being an AU count against the maximum number of Amex cards that someone could have?

@ Bill -- It doesn't.

I can verify. I was an authorized user on my wives spg personal card for years and during this years increased 35,000 i had her refer me for the bonus. She got 5000 points I have gotten the first 25000 points so the next 10,000 should post once i hit that min spend. Fyi I am pretty sure adding authorized users does automatically count against someones 5/24 status. Supposedly you can appeal that via phone,...

I can verify. I was an authorized user on my wives spg personal card for years and during this years increased 35,000 i had her refer me for the bonus. She got 5000 points I have gotten the first 25000 points so the next 10,000 should post once i hit that min spend. Fyi I am pretty sure adding authorized users does automatically count against someones 5/24 status. Supposedly you can appeal that via phone, but something to consider. Of course the amex business cards should not count against 5/24 either personal primary or authorized users should be safe.

Another reason to add a person on AMEX cards is that it will give them a credit history. If your payments $0 balance and credit history is good with AMEX you can add a person and it will be reflected on their credit report as an open card with good credit. I just did this for my college student son who is just entering the business world and getting married soon. He has and will...

Another reason to add a person on AMEX cards is that it will give them a credit history. If your payments $0 balance and credit history is good with AMEX you can add a person and it will be reflected on their credit report as an open card with good credit. I just did this for my college student son who is just entering the business world and getting married soon. He has and will never even see the card most likely but I added him. He had no credit history prior but now is showing about 750'ish score. Now this will not allow him to do hard core stuff like get a car loan or mortgage because although it gives him a good score the history is still weak. It will help with stuff like an apartment lease credit check or that sort of stuff most of the time YMMV.

Other card companies don't work like this and I'm not sure it works like that on all AMEX vendors. In my case I did it with an SPG AMEX. My Dad did this for me about 30 years ago with a Bestwestern or Amoco AMEX, I can't remember.

@Ethan No, being an AU doesn't preclude you from getting the same card for yourself, including the sign up bonus.

Does adding an AU generally forfeit the AU's ability to sign up for the same card and earn its sign up bonus?