I frequently write about promotions for purchasing airline miles and hotel points, as this can represent an excellent value.

While I generally don’t recommend buying points without a particular use in mind, in some cases you can get outsized value, particularly for aspirational redemptions (whether that’s a five star hotel or first class flight).

While we’ve seen some award costs increase over the years, we’ve for the most part continued to see robust promotions for purchasing points. These often get better and better to account for the devaluations we’ve otherwise seen.

While the main consideration when buying points should be that the deal as such makes sense, in this post I wanted to talk about what credit card you should use when buying points. This might not be as obvious as it sounds, since different programs go about points purchases in different ways.

Using the right credit card can make a material difference in terms of the value you get.

In this post:

Maximizing credit card rewards when buying points

Using the best credit card to purchase points might not be quite as straightforward as it sounds. This is due to an important distinction with how loyalty programs choose to process these purchases:

- If the airline or hotel program processes points purchases directly, you’ll want to use a credit card that offers bonus points for airfare and hotel purchases; that’s because the purchase of points is processed the same way as an airfare or hotel purchase

- A lot of loyalty programs use points.com to process points purchases, in which case that wouldn’t qualify as an airfare or hotel purchase; in that case you’ll want to use a card that maximizes your return on everyday spending

With that in mind, let’s talk about some of the most popular programs for purchasing points, and how they process those transactions.

Which loyalty programs process points purchases directly?

The following programs process points purchases directly (and therefore points purchases with them qualify as airline spending):

The following programs use points.com for points purchases (and therefore points purchases with them generally don’t qualify as airline or hotel spending):

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- Alaska Mileage Plan

- British Airways Executive Club

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- Iberia Plus

- JetBlue TrueBlue

- Qatar Airways Privilege Club

- Southwest Rapid Rewards

- United MileagePlus

- Choice Privileges

- Hilton Honors

- IHG One Rewards

- Marriott Bonvoy

- Radisson Rewards

- Shangri-La Circle

- World of Hyatt

- Wyndham Rewards

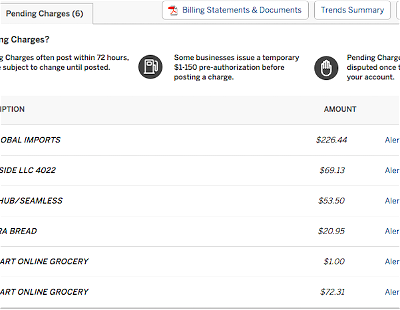

When points.com processes the purchase, you’ll see a points.com logo at the bottom of the purchase page, as you can see below.

Which credit card should you use to buy points?

As you can see above, some airline programs process points purchases directly. In those instances, you’re best off using a card that offers bonus points on airfare spending.

Those typically include the co-branded credit cards of the respective airline, or otherwise, your best bet would be one of the below, which are flexible cards offering bonus points on airfare purchases.

The Platinum Card® from American Express

The Platinum Card® from American Express

American Express® Gold Card

American Express® Gold Card

As you can see, some cards offer up to 5x flexible points per dollar spent, and I value those points at 1.7 cents each. To me that’s like an incremental 8.5% return on that spending, which is incredible.

Furthermore, for these purchases you can also potentially take advantage of some travel credits offered by cards:

- The Chase Sapphire Reserve® (review) offers a $300 annual travel credit, which can be used to purchase miles with an airline that processes the purchase directly

- The Citi Prestige Card offers a $250 annual travel credit, which can be used to purchase miles with an airline that processes mileage purchases directly

So, the above is my advice if buying points from an airline that processes mileage purchases directly. But what about the other airline and hotel programs, which process points purchases through points.com?

My general advice with points.com purchases is to:

- First use a credit card on which you’re trying to reach minimum spending requirement in order to earn a sign-up bonus, since this is a great non-bonused category in which to do so

- Then use a credit card that helps you maximize your return on everyday, non-bonused spending; this includes cards like the Chase Freedom Unlimited® (review), Citi Double Cash® Card (review), Capital One Venture Rewards Credit Card (review) (Rates & Fees), and Capital One Venture X Rewards Credit Card (review) (Rates & Fees)

- Keep in mind that if you’re buying points from a program that bills points purchases in a foreign currency, you’ll want to use a card with no foreign transaction fees, so I’d recommend the Capital One cards, since they don’t have foreign transaction fees

- Earn 1% cash back when you make a purchase, earn 1% cash back when you pay for that purchase

- $0

- Earn 3% Cash Back on Dining

- Earn 3% Cash Back at Drugstores

- Earn 1.5% Cash Back On All Other Purchases

- $0

- Earn 2x miles on every purchase

- No Foreign Transaction Fees

- 10,000 bonus miles every account anniversary

- $395

- Earn unlimited 2X miles on every purchase, every day

- No Foreign Transaction Fees

- Global Entry/TSA Pre-Check Credit

- $95

- 2x points on purchases up to $50k then 1x

- Access to Amex Offers

- No annual fee

Bottom line

For many, buying points is one of the best ways to book premium cabin airline tickets or five star hotels at huge discounts. If you want to maximize the return you get out of your miles & points purchases, it’s valuable to understand how different programs process those purchases.

As you can see above, you can earn up to 5x points on points purchases processed directly by airlines, and up to 2x points on purchases processed through points.com, which personally I value as an incremental return of 3.4-8.5%.

Which credit card do you use when buying points?

Airline and hotel points are not flexible, so only purchase if you have an immediate need

When not spending towards a SUB, I'd use one of my 2x BoA Customized Cash cards, with Platinum Honors, for 5.25% back on Online Shopping. That bonus category is amazing, I have both my cards set to it.

Thanks for confirming it codes as Online Shopping!

Unless you've found availability that fits your schedule and plans, and will clearly give you value as points redemption versus cash, please don't buy points with your hard earned cash. Otherwise, you will often not get the outsized value that many bloggers write about - because your life is not as flexible as theirs - and more likely to just get something like a $0.01/point return.

Points.com purchases count for the "Online" category of the BoA Customized Cash Rewards card. So that's 3%. It also stacks with the Preferred Rewards program, so you'd get a 3.75-5.25% return.

Cashback portals used to have points.com as an option as recently as a few weeks ago, but I don't see them listed in the ones I use anymore... That added a few percent.